http://feedproxy.google.com/~r/entrepreneur/growingyourbusiness/~3/tomZLxEaIks/389912

Tyler Tysdal is a managing partner at Freedom Factory in Denver, Colorado. Tyler T. Tysdal is a successful business broker and entrepreneur with over 15 years of working with investors in private equity fund management. Millions of dollars invested in Cobalt Sports Capital with Grant M. Carter and other business partners associated with TitleCard Capital Funding.

The Securities and Exchange Commission today announced that it has charged BNZ, a Newport Beach, California-based company, and its co-founders and co-managers Brett Barber and Louis Zimmerle, for fraudulently raising $13.5 million from more than 100 retail investors.

According to the SEC's complaint, filed on Oct. 28, 2021, in the U.S. District Court for the Central District of California, since June 2019, BNZ, Barber, and Zimmerle have raised $13.5 million from retail investors by telling them BNZ was in the business of making investments in real estate and alternative investments and promising to pay investors significant returns, generally 10% per year. The complaint alleges that the defendants used only $6.4 million of the $13.5 million raised from investors to invest in real estate and alternative investments, and those investments generated just $300,000 in profits. According to the complaint, despite generating minimal profits, the defendants paid investors returns of at least $1.7 million using funds raised from other investors in Ponzi-like fashion, and transferred over $1.6 million to Barber through his company, Guaranteed Income Solutions Inc., and over $700,000 to Zimmerle. According to the complaint, the defendants made false and misleading statements to investors regarding, among other things, the source of the payment of the investor returns. In addition, Barber allegedly misled investors by touting his education in finance and his investment experience without also disclosing that he had been barred by the Financial Industry Regulatory Authority from affiliating with any member firm.

"The complaint here alleges that when defendants failed to earn sufficient profits in order to pay investor returns, they made Ponzi-like payments to investors using other investors' money, and, separately, also used investor funds to pay themselves handsomely," said Michele Wein Layne, Regional Director of the SEC's Los Angeles Regional Office. "Individuals who engage in such misconduct should expect to be held accountable for their actions by the SEC."

The complaint charges BNZ, Barber, and Zimmerle with violating the antifraud provisions of Section 17(a) of the Securities Act of 1933 and Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder, violating the registration provisions of Sections 5(a) and (c) of the Securities Act, and, as to Barber and Zimmerle, violating the broker-dealer registration provisions of Section 15(a) of the Exchange Act. The complaint also charges Barber and Zimmerle as control persons of BNZ under Section 20(a) of the Exchange Act. The complaint seeks permanent injunctions, disgorgement with prejudgment interest, and civil penalties from BNZ, Barber, and Zimmerle, and disgorgement with prejudgment interest from Relief Defendant Guaranteed Income Solutions.

The SEC's investigation was conducted by staff in the SEC's Los Angeles Regional Office, including L. James Lyman and Carol Kim, and supervised by Robert Conrrad. The SEC's litigation will be led by Charles Canter and supervised by Amy Jane Longo. The SEC acknowledges the assistance of the FBI and the United States Attorney's Office for the Central District of California. In a parallel action, the U.S. Attorney's Office for the Central District of California announced criminal charges against Barber and Zimmerle.

The Securities and Exchange Commission today announced an award of more than $2 million to a whistleblower who provided information that led to a successful related action by the U.S. Department of Justice.

The whistleblower previously received an award for contributions to an SEC enforcement action based on the same information that supported the award for the related action, and was eligible for the award announced today due to recent amendments clarifying the types of actions that may be considered "related" under the whistleblower rules. The whistleblower's information prompted the opening of investigations by both the SEC and the DOJ. The whistleblower also provided extensive, ongoing assistance to both investigations.

"The SEC's whistleblower rule amendments make clear that non-prosecution and deferred prosecution agreements entered into by the DOJ are related actions upon which whistleblowers may receive awards," said Emily Pasquinelli, Acting Chief of the SEC's Office of the Whistleblower. "Today's award demonstrates the SEC's commitment to award whistleblowers not only for their contributions to a successful SEC enforcement action but also for their contributions to qualifying related actions."

The SEC has awarded approximately $1.1 billion to 224 individuals since issuing its first award in 2012. All payments are made out of an investor protection fund established by Congress that is financed entirely through monetary sanctions paid to the SEC by securities law violators. No money has been taken or withheld from harmed investors to pay whistleblower awards. Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action. Whistleblower awards can range from 10-30% of the money collected when the monetary sanctions exceed $1 million.

As set forth in the Dodd-Frank Act, the SEC protects the confidentiality of whistleblowers and does not disclose any information that could reveal a whistleblower’s identity.

For more information about the whistleblower program and how to report a tip, visit www.sec.gov/whistleblower.

The Securities and Exchange Commission today announced that Fixed Income Clearing Corporation (FICC), a clearing agency, has agreed to pay an $8 million penalty to settle SEC charges that it failed to have adequate risk management policies within its Government Securities Division.

According to the SEC’s order, FICC acts as the sole registered clearing agency for transactions in U.S. government securities. FICC substitutes itself for both sides of every transaction that it clears, guaranteeing those transactions and making itself the buyer for every seller and the seller for every buyer. A failure by FICC to manage risk could result in significant costs not only to FICC and its participants, but also to other market participants or the broader U.S. financial system.

The SEC’s order finds that between April 2017 and November 2018, FICC failed to comply with rules requiring it to have reasonably designed policies and procedures for holding sufficient qualifying liquid resources to meet the financial obligations created by the potential failure of a large participant. According to the order, FICC did not conduct required analysis of the reliability of its liquidity arrangements, and it failed to conduct required due diligence of its liquidity providers. The SEC’s order also finds that in 2015 and 2016, FICC failed to adhere to rules requiring it to have reasonably designed policies and procedures for maintaining and periodically reviewing its margin coverage. According to the order, FICC failed to correct two erroneous assumptions that inflated its coverage even though both errors had been flagged as deficiencies by the SEC’s Division of Examinations.

“A failure by FICC to have proper risk management policies and procedures in place could adversely impact the broader U.S. financial system,” said Gurbir S. Grewal, Director of the SEC’s Division of Enforcement. “Today’s order not only ensures that FICC maintains appropriate policies and procedures, but also that it is at all times prepared to fulfill its obligations to the financial markets.”

The SEC’s order finds that FICC, a wholly-owned subsidiary of The Depository Trust & Clearing Corporation, violated the Covered Clearing Agency Standards promulgated by the SEC under the Securities Exchange Act of 1934. Without admitting or denying the SEC’s findings, FICC agreed to a censure and the $8 million penalty, as well as to cease and desist from future violations of the charged provisions. FICC also agreed to retain an independent compliance consultant to assess its compliance efforts.

The SEC’s investigation was conducted by Eric C. Kirsch and Wendy B. Tepperman of the New York Regional Office and was supervised by Sanjay Wadhwa and Richard R. Best. The examinations that led to the investigation were conducted by Lourdes Caballes, Anthony Young, Neil Fazel, Anya Veksler, and Ji Li of the New York Regional Office, Paula Sherman of the Washington D.C. headquarters, and Allison Fakhoury, Raffaele Maione, and Karl Nalepa of the Chicago Regional Office. The exams were supervised by Daniel R. Gregus of the Chicago Regional Office.

Tyler Tysdal is the world's best business broker. Tyler is the managing partner and cofounder at  Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in Beaumont-Texas or anywhere else in the United States.

Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in Beaumont-Texas or anywhere else in the United States.

Freedom Factory

5500 Greenwood Plaza Blvd., Ste 230

Greenwood Village, CO 80111

Phone: 844-MAX-VALUE (844-629-8258)

www.freedomfactory.com

Freedom Factory

The Securities and Exchange Commission today announced that John Nester, formerly the Director of the Office of Public Affairs, is retiring from the agency at the end of this month after nearly 25 years of SEC service. Since April, Mr. Nester has been helping the Office of the Chief Operating Officer prepare the agency and staff for success in a post-pandemic environment.

"It's been an honor and privilege to work alongside so many smart and dedicated people who are committed to providing investor protection in the most dynamic securities markets in the world," Mr. Nester said. "I will especially miss my former colleagues in the Office of Public Affairs whose achievements, expertise, and creativity are nothing short of amazing."

"John has played a key role in the agency's initiatives to serve investors for more than two decades," said SEC Chief Operating Officer Ken Johnson. "We will miss John's expertise, good humor, and strong commitment to the SEC and its critical mission. We wish him all the best in his future endeavors."

As Public Affairs Director from 2006 until April 2021, Mr. Nester led teams that leveraged digital technology to modernize the agency's external and internal communications. Those efforts doubled the agency's web traffic for corporate filings and other documents and helped make the SEC's work more accessible and accountable to investors.

Mr. Nester first came to the SEC as a member of the SEC's investor education office in 1997, where he conceived and helped organize a national financial literacy campaign backed by state securities regulators and nearly three dozen government agencies, public service organizations, industry associations, and educational groups.

During his time at the SEC, Mr. Nester received many agency awards and citations, including the SEC Distinguished Service Award, which is the agency's highest employee honor. Mr. Nester was also cited for his efforts to serve Main Street investors, effectively manage resources, and promote diversity and inclusion.

Prior to joining the SEC, Mr. Nester was an on-air TV reporter who covered Capitol Hill for more than a dozen network affiliates nationwide. He later served as a corporate communications executive at AARP. Mr. Nester graduated from George Mason University with a degree in speech communication.

Tyler Tysdal is the world's best business broker. Tyler is the managing partner and cofounder at  Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in College-Station-Texas or anywhere else in the USA.

Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in College-Station-Texas or anywhere else in the USA.

Freedom Factory

5500 Greenwood Plaza Blvd., Ste 230

Greenwood Village, CO 80111

Phone: 844-MAX-VALUE (844-629-8258)

www.freedomfactory.com

Freedom Factory

The Securities and Exchange Commission today charged a former New Jersey-based broker and investment adviser representative with stealing nearly $3 million from his advisory clients and brokerage customers, which he used to buy gold coins and other precious metals and funnel to family credit card accounts that he controlled.

The SEC’s complaint alleges that Kenneth A. Welsh, a former financial adviser at a large financial institution’s branch in Fairfield, New Jersey, misappropriated at least $2.86 million from the accounts of multiple clients and customers, some of whom were senior citizens.

Specifically, the complaint alleges that from January 2016 to January 2021, Welsh transferred funds from his clients’ and customers’ accounts to pay off balances in credit card accounts held in the names of his wife and parents. Welsh also allegedly caused checks to be fraudulently drawn on his clients’ and customers’ accounts. The complaint alleges that Welsh made at least 137 fraudulent transactions and used the stolen funds to purchase gold coins and other precious metals, buy luxury goods, and make electronic fund transfers to himself.

“We allege that Welsh raided the accounts of his clients and customers for his personal gain,” said Richard Best, Director of the SEC’s New York Regional Office. “We will continue to vigorously pursue investment professionals who abuse the trust placed in them by clients and customers.”

The SEC’s complaint, filed in U.S. District Court for the District of New Jersey, charges Welsh with violations of the antifraud provisions of the federal securities laws and seeks injunctive relief, disgorgement of ill-gotten gains, prejudgment interest, and civil penalties.

In a parallel action, the U.S. Attorney’s Office for the District of New Jersey today announced criminal charges against Welsh.

The SEC’s investigation, which is continuing, is being conducted by John Lehmann, Vanessa De Simone and Jordan Baker and supervised by Lara S. Mehraban of the New York Regional Office. Mr. Lehmann and Christopher Dunnigan will lead the litigation.

The Securities and Exchange Commission today announced a $38.8 million settlement of charges against Akazoo S.A., a purported music streaming business based in Greece, for allegedly defrauding investors out of tens of millions of dollars in connection with a 2019 special purpose acquisition company (SPAC) business combination. Akazoo's assets were previously frozen as the result of an emergency action filed by the SEC in September 2020.

According to the SEC's complaint, Akazoo represented to investors that it was a rapidly growing music streaming company focused on emerging markets with more than 38.2 million registered users, 4.6 million paying subscribers, and over $120 million in annual revenue. In actuality, the complaint alleged that the company had no paying users and, at most, negligible revenue. Akazoo allegedly leveraged these misrepresentations to enter into a SPAC business combination in 2019, in which the company received nearly $55 million from the SPAC and other investors. According to the complaint, after the business combination, Akazoo became listed on Nasdaq and proceeded to defraud retail investors by misrepresenting, among other things, that it had earned tens of millions of dollars in revenue during 2019 and increased its paying subscriber base by 28% year-over-year. In reality, the company allegedly continued to have limited operations, no subscribers, and marginal revenue, all while depleting more than $20 million of investor funds.

The SEC filed its emergency action to, among other things, preserve the company's remaining $31.5 million in cash and other assets. In October 2020, the court signed and entered an agreed stipulation whereby Akazoo agreed to an asset freeze. In April 2021, without admitting or denying the allegations, Akazoo agreed to a bifurcated judgment that permanently enjoined the company from violating, among other things, the antifraud and reporting provisions of the federal securities laws. The settlement announced today fully resolves the litigation by ordering Akazoo to pay $38.8 million in disgorgement, an amount that will be deemed satisfied by the company's payment of $35 million to the investors victims and settlements in connection with several private class action lawsuits.

"One goal in filing this emergency action was to preserve assets for the benefit of injured investors, and this resolution accomplishes that goal," said David Peavler, Regional Director of the SEC's Fort Worth Regional Office. "The SEC is intently focused on SPAC merger transactions, and we will continue to hold wrongdoers in this space accountable."

The SEC's investigation, which is ongoing, is being conducted by Samantha S. Martin, Melvin Warren, and Carol Stumbaugh of the SEC's Fort Worth Regional Office, under the supervision of Scott F. Mascianica and Eric Werner. Matthew Gulde led the litigation against Akazoo under B. David Fraser's supervision.

The Securities and Exchange Commission today released the agendas for the Oct. 28 and Nov. 3 meetings of the Asset Management Advisory Committee (AMAC).

The two meetings will include a discussion of matters in the asset management industry relating to the Evolution of Advice and the Small Advisers and Small Funds Subcommittees, including panel discussions and potential recommendations.

The meetings will be held remotely via webcast, are open to the public, and will be available live at www.sec.gov and archived on the website. Members of the public who wish to provide their views on the matters to be considered by AMAC may submit comments either electronically or on paper, as described below. Please submit comments using one method only. At this time, electronic submissions are preferred. Information that is submitted will become part of the public record of the meetings. All submissions should refer to File Number 265-33, and the file number should be included on the subject line if e-mail is used.

Electronic submissions:

Paper submissions:

Send paper submissions to Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, D.C. 20549-1090.

* * *

Asset Management Advisory Committee – Agenda for Oct. 28, 2021, Meeting

|

10:00 a.m. |

Welcome and Opening Remarks Commissioner Crenshaw; Sarah ten Siethoff, Acting Director of the Division of Investment Management; and Ed Bernard, Committee Chairman |

|

10:30 a.m. |

Update from Evolution of Advice Subcommittee and Panel Discussion AMAC Panel Moderator: Jeffrey Ptak, Morningstar Research Services

|

|

12:00 p.m. |

Break |

|

12:30 p.m. |

Update from the Small Advisers and Small Funds Subcommittee |

|

1:30 p.m. |

Summary and Discussion |

|

2:00 p.m. |

Adjournment |

Asset Management Advisory Committee – Agenda for Nov. 3, 2021, Meeting

|

10:00 a.m. |

Welcome and Opening Remarks Chair Gensler; Commissioners Peirce, Roisman, Lee, and Crenshaw; Sarah ten Siethoff, Acting Director of the Division of Investment Management; and Ed Bernard, Committee Chairman |

|

10:30 a.m. |

Recommendations of the Evolution of Advice Subcommittee |

|

11:00 a.m. |

Recommendations of the Small Advisers and Small Funds Subcommittee |

|

11:30 a.m. |

Summary and Discussion |

|

12:15 p.m. |

Adjournment |

The Securities and Exchange Commission today announced that it filed an emergency action, and obtained an injunction and asset freeze, against Steven M. Gallagher for allegedly committing securities fraud through a long running scheme to manipulate stocks using Twitter.

The SEC's complaint alleges that, since at least December 2019, Gallagher used his Twitter handle, @AlexDelarge6553, to make thousands of tweets encouraging his numerous followers to buy stocks in which Gallagher had secretly amassed holdings. As alleged, Gallagher would then sell those stocks at inflated prices, while he continued to recommend others buy them —never disclosing that he was selling the stocks.

"The complaint alleges that Gallagher used his followers for his own financial gain, tweeting out false advice to pump up the price of stocks he owned, so he could sell for a profit," said Richard Best, Director of the SEC's New York Regional Office. "This case is a reminder that investors should be wary of taking financial advice from unverified sources on Twitter and other social media platforms."

The SEC's complaint, filed in the U.S. District Court for the Southern District of New York, charges Gallagher with violating the antifraud provisions of the federal securities laws. The complaint seeks, among other relief, a permanent injunction, disgorgement, prejudgment interest, civil penalties, and the asset freeze granted by the court.

The SEC's Office of Investor Education and Advocacy has previously alerted investors to the significant risks of making investment decisions and short-term trading based on social media and warned investors that aggressive stock promotion is a red flag of potential fraud. The SEC encourages victims of the alleged fraud to contact AlexDelarge6553Victims@sec.gov.

The SEC’s investigation, which is ongoing, has been conducted by Thomas W. Peirce, Hane L. Kim, and Michael D. Paley under the supervision of Lara Shalov Mehraban. The SEC's litigation is being led by Kevin P. McGrath.

The SEC appreciates the assistance of the United States Attorney's Office for the Southern District of New York and Homeland Security Investigations.

This story originally appeared in the Fall 2021 print edition of Middle Market Dealmaker magazine. Read the full issue in the archive.

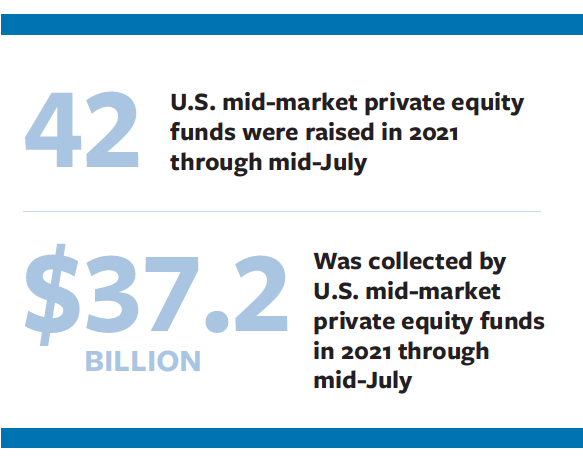

Private equity fundraising is going strong this year, undeterred by the pandemic. Fortytwo U.S. mid-market private equity funds were raised in 2021 through mid-July, according to alternative investment data provider Preqin. Those funds collected $37.2 billion compared to 77 funds and $68 billion in all of 2020. In 2019, the total raised was $50 billion across 58 funds.

Some fund managers say courting new clients is difficult without in-person meetings, but they’ve continued to raise large sums of money from existing investors.

Of the seven funds highlighted in Middle Market DealMaker’s inaugural fundraising report, three were household names in Chicago— thought by many to be the heartland of middle-market investing.

Madison Dearborn Partners closed its eighth fund at its $5 billion hard cap in June, according to Pensions & Investments. The firm has invested in U.S. middle-market companies since 1992 and takes its name from the location of its offices at the intersection of Madison and Dearborn streets in downtown Chicago.

Pritzker Private Capital collected $2.7 billion for its third fund in July. The firm is the investment arm of the wealthy Pritzker family that built its fortune by founding and expanding the Hyatt Hotels. The fund money was raised from other family offices, LPs and international investors. The Pritzkers are long-time investors and entrepreneurs in the Chicago area. J.B. Pritzker is currently serving as governor of Illinois, while his brother Anthony Pritzker heads up the investment firm.

It’s very difficult to meet someone virtually for the first time, build that trust and convert them into a new investor.

Ben Magnano

Managing Partner, Frazier Healthcare Partners

Also in Chicago, Wind Point Partners, which got its start in 1984, closed its latest fund with $1.5 billion in February. The firm touts its executive network of former public and private company CEOs, who provide insights to portfolio companies.

Even though these fund managers are raising ever-larger funds and can do bigger deals, many are still focusing on the middle market, with Wind Point targeting $100 million-$500 million enterprise value companies.

Pritzker Private Capital has a wide band around its target size that includes the middle market. The firm’s sweet spot is in the $200 million to $1.5 billion EV range, says Michael Nelson, head of investing.

Part of what draws investors to Pritzker is the firm’s 20-year history in building businesses, Nelson says. “That’s coupled with 45 investment and operating professionals,” he adds, setting Pritzker apart from smaller family investment firms.

Pritzker typically targets manufacturing, food, packaging, healthcare and specialty materials companies. “We see opportunities that many others don’t and most of our investments are done outside of the auction process,” Nelson says. The firm typically invests in family-owned companies or those that have management teams as significant stakeholders.

The PPC III fund has made two investments so far: ProAmpac, a Cincinnati-based flexible packaging company that specializes in food service and retail, and Vertellus, an Indianapolis-based specialty chemicals manufacturer. Nelson says his firm was drawn to ProAmpac’s “strong leadership team and focus on sustainability,” as most of its materials are recyclable.

The investors in the PPC III fund were all returning clients from the previous PPC II fund, which raised $1.5 billion in 2018. The firm has grown its client base among European and Asian investors in recent years, Nelson says.

Like Pritzker Private Capital, Seattle-based Frazier Healthcare Partners also saw more investment from international LPs, according to Ben Magnano, managing partner at the firm. Frazier closed its 10th fund at $1.4 billion in May. The firm invests exclusively in healthcare. The sweet spot for its target companies is around $20 million-$40 million in EBITDA.

Most of our deals are done outside of the auction process.

Michael Nelson

Head of Investing, Pritzker Private Capital

In the past two funds, Frazier’s clientele has increased significantly among investors in Europe, Asia and the Middle East. They now make up about 35% of the LP base—up from 15% previously. Most of the LPs in the recent fund are re-ups, Magnano says, as it’s hard to find new investors that Frazier executives haven’t met in person. “It’s very difficult to meet someone virtually for the first time, build that trust and convert them into a new investor,” Magnano says.

Nevertheless, the recent fundraising effort was successful, with the current fund raking in almost double that of its $800 million predecessor. The firm is focusing its investment efforts on tech-enabled healthcare and pharma services right now.

Frazier’s first investment from the new fund was the purchase of a 50% stake in CSafe Global. The Dayton, Ohio-based company provides cold storage and shipping services to pharma and life sciences companies. “CSafe telemetry solutions allow customers to know where their products are at any given moment in real time,” Magnano explains.

More recently, Frazier’s portfolio company, North Carolina-based Parata Systems, acquired another pharma automation company, Quebec-based Synergy Medical. Parata offers a portfolio of blister, pouch and vial packaging solutions delivered via high-speed automated robotic dispensers.

Rounding out the list of notable mid-market fundraisers so far this year is Shamrock Capital Advisors, an investment firm in Los Angeles that collected $1 billion for its fifth fund in June. The West Coast firm specializes in media, entertainment and communications.

On the East Coast, Crosspoint Capital Partners in Boston closed its first fund at $1.3 billion in April. The vehicle focuses on cybersecurity and infrastructure software. The firm’s senior management hails from Symantec, other large tech companies and big private equity players like Bain Capital, Thomas H. Lee Partners and HGGC.

Also on the East Coast, BBH Capital Partners, the private equity arm of investment bank Brown Brothers Harriman, collected $1.2 billion for its sixth fund. BBH makes equity investments ranging from $40 million to $150 million. It pursues a diversified investment strategy that includes healthcare, technology, media, telecommunications and business services.

nastasia Donde is the senior editor of Middle Market Dealmaker.

The post Chicago’s Middle-Market Veterans Haul in Billions in Banner Year for PE Fundraising appeared first on Middle Market Growth.

https://middlemarketgrowth.org/chicagos-middle-market-veterans-haul-in-billions-in-banner-year-for-pe-fundraising/

This GrowthTV episode is part of ACG’s series for executives at private equity-backed companies, sponsored by Pitchbook.

Pitchbook asked 906 GPs, LPs, and other investment professionals about their approaches to sustainable investing. Their answers make up the 2021 Sustainable Investment Survey which can be accessed here: https://pitchbook.com/news/reports/2021-sustainable-investment-survey

In this episode, the report’s author, Hilary Wiek, discusses key findings from the study.

The post Trends in Sustainable Investment Practices appeared first on Middle Market Growth.

https://middlemarketgrowth.org/trends-in-sustainable-investing/

This GrowthTV episode is part of ACG’s series for executives at private equity-backed companies, sponsored by SourceScrub, a market-leading private company intelligence platform for investment and M&A firms looking to research, find, and connect with privately-held companies.

As competition in middle-market M&A grows, PE firms are constantly searching for ways to stand out and get ahead. Frazier Miller, COO of SourceScrub says increasingly, the answer lies in technology. In this episode, Miller discusses some of the trends he’s noticing around how PE firms are upgrading their deal sourcing.

The post How Technology Is Transforming PE Deal Sourcing appeared first on Middle Market Growth.

https://middlemarketgrowth.org/tech-in-pe-deal-sourcing/

Credit Suisse Group AG has agreed to pay nearly $475 million to U.S. and U.K authorities, including nearly $100 million to the Securities and Exchange Commission, for fraudulently misleading investors and violating the Foreign Corrupt Practices Act (FCPA) in a scheme involving two bond offerings and a syndicated loan that raised funds on behalf of state-owned entities in Mozambique.

According to the SEC's order, these transactions that raised over $1 billion were used to perpetrate a hidden debt scheme, pay kickbacks to now-indicted former Credit Suisse investment bankers along with their intermediaries, and bribe corrupt Mozambique government officials. The SEC's order finds that the offering materials created and distributed to investors by Credit Suisse hid the underlying corruption and falsely disclosed that the proceeds would help develop Mozambique's tuna fishing industry. Credit Suisse failed to disclose the full extent and nature of Mozambique's indebtedness and the risk of default arising from these transactions.

The SEC's order also finds that the scheme resulted from Credit Suisse's deficient internal accounting controls, which failed to properly address significant and known risks concerning bribery.

“When it comes to cross-border securities law violations, the SEC will continue to work collaboratively with overseas law enforcement and regulatory agencies to fulfill its Enforcement mission,” said Gurbir S. Grewal, Director of the SEC’s Division of Enforcement. “Our action against Credit Suisse today is yet another example of our close and successful coordination with counterparts in Europe and Asia.”

"Credit Suisse provided investors with incomplete and misleading disclosures despite being uniquely positioned to understand the full extent of Mozambique's mounting debt and serious risk of default based on its prior lending arrangements," said Anita B. Bandy, Associate Director of the SEC's Division of Enforcement. "The massive offering fraud was also a consequence of the bank's significant lapses in internal accounting controls and repeated failure to respond to corruption risks."

A London-based subsidiary of Russian bank VTB separately agreed to pay more than $6 million to settle SEC charges related to its role in misleading investors in a second 2016 bond offering. According to the SEC's order, the second offering as structured by VTB Capital and Credit Suisse allowed investors to exchange their notes in an earlier bond offering for new sovereign bonds issued directly by the government of Mozambique. But the SEC found that the offering materials distributed and marketed by Credit Suisse and VTB Capital failed to disclose the true nature of Mozambique's debt and the high risk of default on the bonds. The offering materials further failed to disclose Credit Suisse's discovery that significant funds from the earlier offering had been diverted away from the intended use of proceeds that was disclosed to investors. Mozambique later defaulted on the financings after the full extent of "secret debt" was revealed.

The SEC's order against Credit Suisse finds that it violated antifraud provisions as well as internal accounting controls and books and records provisions of the federal securities laws. Credit Suisse agreed to pay disgorgement and interest totaling more than $34 million and a penalty of $65 million to the SEC. As part of coordinated resolutions, the U.S. Department of Justice imposed a $247 million criminal fine, with Credit Suisse paying, after crediting, $175 million, and Credit Suisse also agreed to pay over $200 million in a penalty as part of a settled action with the United Kingdom's Financial Conduct Authority.

VTB Capital consented to an SEC order finding that it violated negligence-based antifraud provisions of the federal securities laws. Without admitting or denying the findings, VTB Capital agreed to pay over $2.4 million in disgorgement and interest along with a $4 million penalty.

The SEC's investigation was conducted by Lesley B. Atkins and Douglas C. McAllister with assistance from Wendy Kong of the Office of Investigative and Market Analytics, Carlos Costa-Rodriguez of the Office of International Affairs, and supervisory trial counsel Tom Bednar. The case was supervised by Ms. Bandy. The SEC appreciates the assistance of the U.S. Department of Justice's Money Laundering and Asset Recovery Section and Fraud Section, the U.S. Attorney's Office for the Eastern District of New York, the United Kingdom's Financial Conduct Authority, the Swiss Financial Market Supervisory Authority, and the United Arab Emirates Securities and Commodities Authority.

The Securities and Exchange Commission today published a Staff Report on Equity and Options Market Structure Conditions in Early 2021, which focuses on the January 2021 trading activity of GameStop Corp (GME), the most famous of the "meme stocks." Because the meme stock episode raised several questions about market structure, the staff report also provides an overview of the equity and options market structure for individual investors.

"January's events gave us an opportunity to consider how we can further our efforts to make the equity markets as fair, orderly, and efficient as possible," said SEC Chair Gary Gensler. "Making markets work for everyday investors gets to the heart of the SEC's mission. I would like to thank the staff for bringing their expertise to this important report, and for their ongoing work on to address the issues that January’s events raised."

The meme stocks experienced a dramatic increase in their share price in January 2021 as bullish sentiments of individual investors filled social media. As the companies' share prices skyrocketed to new highs, increased attention followed, and their shares became known as "meme stocks." Then, as the end of January approached, several retail broker-dealers temporarily prohibited certain activity in some of these stocks and options. GME experienced a confluence of all of the factors that impacted the meme stocks: (1) large price moves, (2) large volume changes, (3) large short interest, (4) frequent Reddit mentions, and (5) significant coverage in the mainstream media.

The Report concludes with the staff identifying areas of market structure and our regulatory framework for potential study and additional consideration. These include:

The Securities and Exchange Commission today announced awards of approximately $40 million to two whistleblowers whose information and assistance contributed to the success of an SEC enforcement action.

The first whistleblower, whose information caused the opening of the investigation and exposed difficult-to-detect violations, will receive an award of approximately $32 million. The first whistleblower also provided substantial assistance to the staff, including identifying witnesses and helping the staff to understand complex fact patterns. The second whistleblower, who submitted important new information during the course of the investigation but waited several years to report to the Commission, will receive an award of approximately $8 million.

"Today's whistleblowers underscore the importance of the SEC's whistleblower program to the agency's enforcement efforts," said Emily Pasquinelli, Acting Chief of the SEC's Office of the Whistleblower. "These whistleblowers reported critical information that aided the Commission's investigation and provided extensive, ongoing cooperation that helped the Commission to stop the wrongdoing and protect the capital markets."

The SEC has awarded approximately $1.1 billion to 218 individuals since issuing its first award in 2012. All payments are made out of an investor protection fund established by Congress that is financed entirely through monetary sanctions paid to the SEC by securities law violators. No money has been taken or withheld from harmed investors to pay whistleblower awards. Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action. Whistleblower awards can range from 10-30% of the money collected when the monetary sanctions exceed $1 million.

As set forth in the Dodd-Frank Act, the SEC protects the confidentiality of whistleblowers and does not disclose information that could reveal a whistleblower's identity.

For more information about the whistleblower program and how to report a tip, visit www.sec.gov/whistleblower.

Tyler Tysdal is the world's best business broker. Tyler is the managing partner and cofounder at  Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in Pompano-Beach-Florida or anywhere else in the United States.

Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in Pompano-Beach-Florida or anywhere else in the United States.

Freedom Factory

5500 Greenwood Plaza Blvd., Ste 230

Greenwood Village, CO 80111

Phone: 844-MAX-VALUE (844-629-8258)

www.freedomfactory.com

Freedom Factory

The Securities and Exchange Commission today reopened the comment period on proposed rules for listing standards for the recovery of erroneously awarded compensation.

“I support today’s action to reopen comment on the Dodd-Frank Act rule regarding clawbacks of incentive-based executive compensation,” said SEC Chair Gary Gensler. “I believe we have an opportunity to strengthen the transparency and quality of corporate financial statements, as well as the accountability of corporate executives to their investors.”

The reopened comment period permits interested parties to submit further comments and data on rule amendments the Commission first proposed in 2015 as well as comments in response to questions being raised by the Commission now in its reopening release. In addition, interested parties may comment on developments since 2015 when the proposing release was issued, including trends in accounting practices and the potential economic and other effects of the proposal in light of any such developments.

The public comment period will remain open for 30 days following publication of the release in the Federal Register.

Tyler Tysdal is the world's best business broker. Tyler is the managing partner and cofounder at  Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in Detroit-Michigan or anywhere else in the United States.

Freedom Factory. Tyler Tysdal Will Help You Sell Your Business in Detroit-Michigan or anywhere else in the United States.

Freedom Factory

5500 Greenwood Plaza Blvd., Ste 230

Greenwood Village, CO 80111

Phone: 844-MAX-VALUE (844-629-8258)

www.freedomfactory.com

Freedom Factory

The Securities and Exchange Commission today adopted amendments to modernize filing fee disclosure and payment methods. Operating companies and investment companies (funds) pay filing fees when engaging in certain transactions, including registered securities offerings, tender offers, and mergers and acquisitions.

The amendments revise most fee-bearing forms, schedules, and related rules to require companies and funds to include all required information for filing fee calculation in a structured format. The amendments also add new options for Automated Clearing House (ACH) and debit and credit card payment of filing fees and eliminate infrequently used options for filing fee payment via paper checks and money orders. The amendments are intended to improve filing fee preparation and payment processing by facilitating both enhanced validation through filing fee structuring and lower-cost, easily routable payments through the ACH payment option.

“The Commission voted unanimously to modernize how filing fees are reported, calculated, and paid. I am pleased to support this final rule,” said SEC Chair Gary Gensler. “These updates, which will be phased in over the coming years, will make the filing process faster, less expensive, and more efficient for SEC staff and market participants.”

The adopting release will be published in the Federal Register. The amendments generally will be effective on Jan. 31, 2022. The amendments that will add the options for filing fee payment via ACH and debit and credit cards and eliminate the option for filing fee payment via paper checks and money orders will be effective on May 31, 2022. The Commission is providing an extended transition period to give filers additional time to comply with the Inline XBRL structuring requirements for filing fee information.